When a startup first enters the international market, it should be done quickly and cost-effectively. But there are often more questions than answers. At what point to start? How to choose a region? Let’s answer them in this post.

At what point to start?

To form the criteria for choosing a foreign market, you need to clearly understand what kind of business you are building. Every case is unique depending on tasks and goals. Will it be a startup aiming at sales or earning dividends? Define your personal goal and keep focus on it throughout the project.

Where to expand?

Another question that often arises at the initial stage is whether it is worth starting immediately from the foreign market or is it better to first wait for stable revenue on the local market and then go international?

Small- and Medium-Sized Businesses:

Well, it all depends on the profile of the company. For medium and small businesses in the B2B segment and B2C, it is recommended to start right from the international market and not to wait for getting stable local income. There is a risk of making a product in demand in one country, but absolutely useless anywhere else. That’s why SMBs should focus more on market specifics and adopt their product positioning accordingly. If a startup has just recently become profitable in its original location and is starving to reinvest in a new market, torn between the two countries, it risks losing profit in either of them.

Entreprise-Level:

The global expansion is different for the enterprise-level B2B segment. Such processes as hiring, training, re-qualification of employees, and sales are almost the same in large and small businesses. Thus, for the enterprise B2B sector, it makes sense to embark with 1 or 2 low-cost pilot projects in a local market to understand that the new venture gives a measurable proven result for customers. It is even better to go beyond the local market within a cross-border corporation. Enterprise-level companies can easier scale their processes across countries.

Market analysis

One of the most common mistakes founders make is the market selection based on a couple criteria taken from an overall research or some common information.

Market selection is a 5-10 year decision, so it makes sense to take a step back and do a more detailed analysis.

Start with the key criteria:

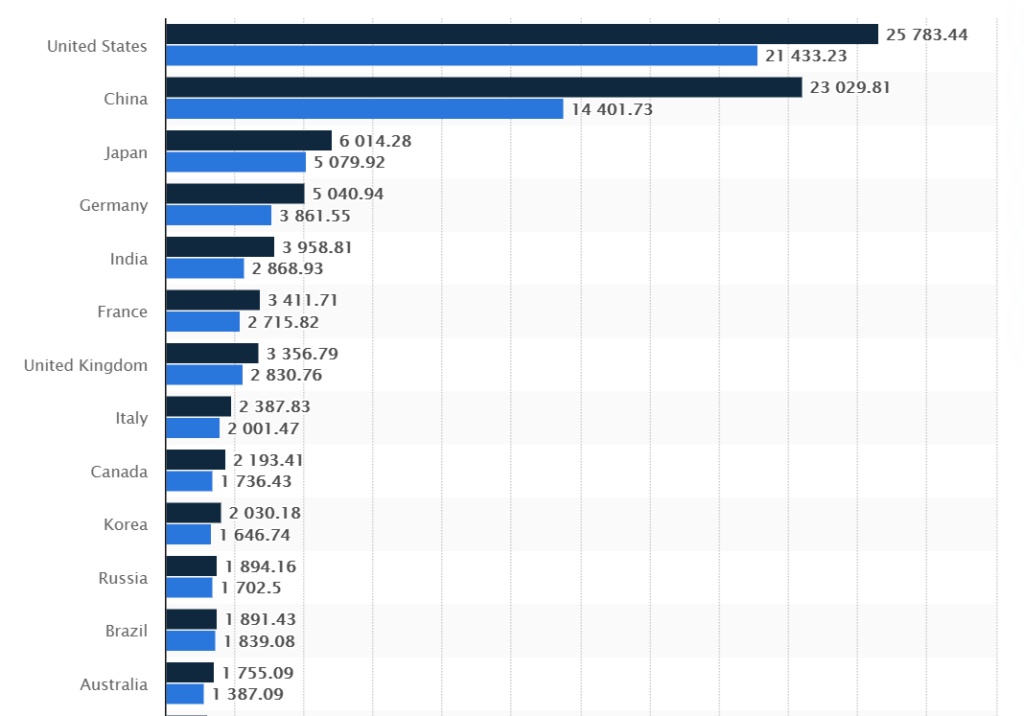

- GDP and its growth rate. The two largest economies in the world are the United States and China. Germany and Great Britain are leading in Europe. Russia provides no more than 2% of world GDP, but it is greater than, for example, Sweden, Belgium or the Netherlands. Therefore, going to any European country is not always a good idea.

- Market structure. For example, about 50% of GDP in the United States is generated by small and medium-sized enterprises (SMEs). In Russia, this figure is less than 20%. But there are also nontrivial cases. For example, in Indonesia there are about 57 million small and medium entrepreneurs, the volume of GDP is $ 1.12 trillion. At first glance, the market seems to be very attractive. The problem, however, is that all of this GDP is generated by micro-businesses with a low liquidity.

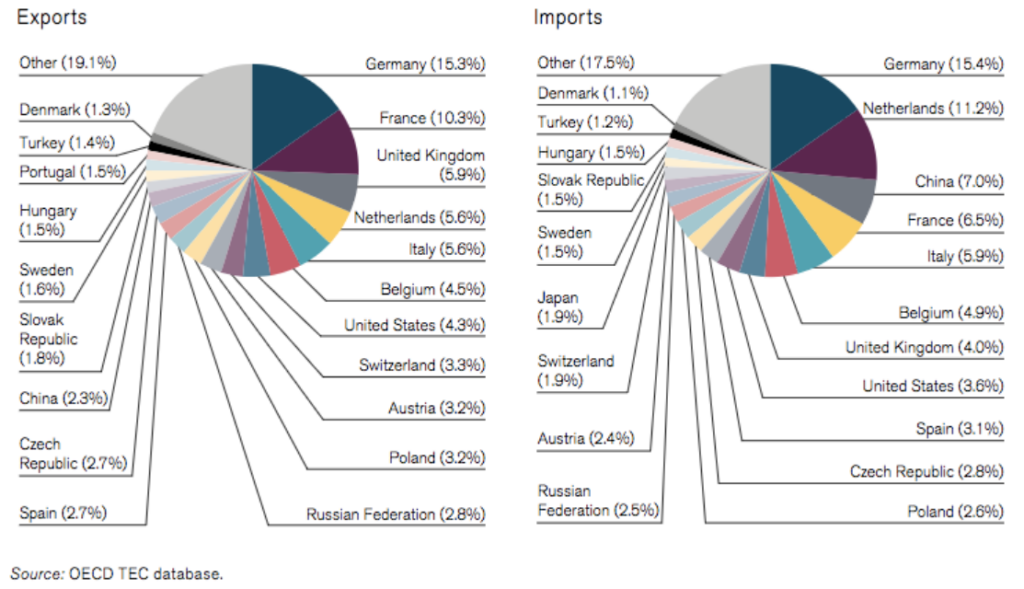

- Culture. The US market is also good for its homogeneous culture – it is the same audience in terms of income and mentality, business relations, and laws formed over almost 100 years of their history. Europe is very heterogeneous, so there is no such a thing as entering the European market – all countries have different GDP, different proportions across industries, different languages, channels to attract customers, media, social networks, decision-making methods. This means that you need to have local expertise everywhere.

- Liquidity and the number of deals – how many IPOs, mergers and acquisitions are there in a particular market? For example, the United States is 100 times more likely to sell a company than Russia, and 10 times more than Germany, Great Britain, and China.

Generally speaking, the market size, its structure, and investment liquidity make the United States the undisputed leader. But not everyone needs to expand there. If you sell a product to another country, try to find a technological or a systemic gap and then go international.

- It is important to target spare niches. For example, call-tracking is very common in the U.S. and Russia, while in other countries it is almost absent. Germany, for example, is 1.5-2 times larger in market size than Russia, and competition in the call-tracking niche is 10 times less.

Private criteria are added to the general criteria:

The number of potential customers, the number of competitors (you should be wary if there are 1-2 key players or dozens of small similar companies) and other parameters related to a specific business, for example, the level of Internet penetration in the country, knowledge of foreign languages, political, cultural and religious restrictions, legislation.

These are all top market data, which may not be enough to give you a full picture before making a decision about global expansion, but at the very least they can help you to define the top 5 or top 10 suitable countries to consider.

Localization is the key to attract and engage new audiences. You should optimize your product content to make it relevant for customers in each of your target countries.

Shane Barker, Digital Strategist, Shane Barker Consulting

Country selection and hypothesis testing

Often, when a startup first quits the local market, it tries to target several regions at once, each of which has different costs for marketing, localization, and selling. This requires large resources, which, as a rule, do not exist. After assessing the market and choosing the top list of suitable countries, there are two scenarios for determining a “suitable” region.

Scenario #1

The first one (the most effective) is enhancing demand. This includes the hypothesis testing through expert interviews and interviews with potential customers. You can even reach out to competitors – for example, pay former or current top managers for advice. This phase can take from 3 to 9 months, but it will allow the company to determine whether its USP (unique selling proposition) and product are in line with the market.

Scenario #2

The second scenario is much simpler and faster, but its results are less transparent. The bottom line is to make a landing page, run ads, for example, on Google or Facebook, and look at the conversion. This method in many cases allows you to determine the demand and value of the paying customer. A campaign can be set up in just a week, spending $ 300-500 on it, and you can quickly see the results. The difficulty is that they are not always unambiguous. For example, if in some countries there are no clicks and transitions at all, this may indicate both a lack of interest or a poor knowledge of the language when creating ads and landing pages.

This method is definitely not suitable for companies in the B2B enterprise segment, since the number of their clients in the country is limited (usually from 20 to 200), and the risk of losing even some of them due to incorrect positioning is not worth that.

Independently of the scenario you choose to test hypotheses on a foreign market, you need an in-house team with native speakers who will be full-time available for this project for at least three months, and a dedicated budget for interviews or advertising. It is better to outsource local resellers after your in-house staff establishes the process, when you’re done with the target audience, customer journey, and the USP.

Key takeaways: 5 steps to expand globally

- Answer the question, what is your personal goal of entering the international market, and follow your goal when planning further.

- If you have a company in the B2B enterprise segment, it makes sense to start with pilot projects in your local market. For medium and small B2B businesses, it is better to go directly to the international market to allot the most of resources to one market.

- Conduct an in-house analysis of markets based on public data – compare regions by GDP, market structure and liquidity. Estimate the number of competitors and potential customers in your niche. Identify additional parameters and stop-factors that are important for your business, compare countries by them. Based on the results of the summary analysis, select the top list of regions suitable for expansion.

- Hire people and assign budget for testing hypotheses – this is a full-time job that needs to be done full time.

- Test the selected regions in one of two ways – using expert interviews and using advertising. Based on the results, choose one of the most promising countries and focus on it for at least 12 months until you get a significant result in terms of customers and revenue. If you hit the right market, then your next task is to dominate it. That would be another 3-5 years of intensive work.

Read more about countries specifics while localizing:

- Mastering Global ECommerce With Advanced Localization

- Localization: How To Speak The Same Language With Your Customers?

- Localization: How To Speak The Same Language With Your Customers? Russia

- Localization: How To Speak The Same Language With Your Customers? The U.S.

- How To Speak The Same Language With The Middle East

- Localization: How To Speak The Same Language With Your Customers? Europe

- Localization: How To Speak The Same Language With Your Customers? China